The headline reads “Shake Shack Confirms Worst Minimum-Wage-Hike’ Fears – “It’s Going Up Too Fast… We Can’t Catch Our Breath”

Yeah Shake Shack. That’s what happens when America tries to catch up after 50 years of underpaying its unskilled laborers.

Before I go any further, ask yourself who has the most “leverage” in the tug-of-war between the wealthiest of Americans and common unskilled laborers? And yes, it is a battle. One that has been ongoing since the medieval days of feudalism.

The answer is obvious. Skilled laborers have power to negotiate when they form labor unions. Unskilled laborers have no such leverage. Which is why, in 1938, the Fair Labor Standards Act was written into law. It’s a shame when people have to be forced to give a shit about the common laborer; but, that’s the sad fact.

Take a look at the Federal Minimum Wage valued in gold and something strange becomes immediately apparent. Minimum wages in terms of gold – which some economists insist is still “real money” – increased steadily until the early ’70s. Then suddenly it fell off a cliff. So what happened?

Could it have anything to do with the Nixon administration’s decision to stop using gold as money? Prior to 1971 the U.S. Dollar had been backed by precious metals. Backed by not just gold but silver, as well. In fact the very word dollar comes from the Anglicised form of “thaler” (pronounced taler, with a long “a”) the name given to coins first minted in 1519 from locally mined silver in Joachimsthal, Bohemia.

When I was a boy, the paper dollars in my pocket didn’t say “Federal Reserve Note” across the top. They said “Silver Certificate”. By law, I could walk into any bank and trade the dollar I received for each hour I worked as a “grocery boy” for a coin that contained an ounce of pure silver – a silver dollar.

A one ounce silver coin today, 5 May 2017, is worth $18.00. I know because my wife and I bought more of them, yesterday.

Before 1971, the currency created by the Central Banks of the world was “backed” by precious metals. In other words paper francs, pesos, marks, dollars, dinar, etc. were redeemable in gold or silver. There was also silver in the coins in our pockets (other than nickels and pennies) until 1967. A half dollar contained a half-ounce, a quarter a fourth-of-an-ounce, and a dime a tenth-ounce of silver. All U.S. coins after 1967 have been minted in much less expensive nickel and copper. The silver coins quickly disappeared from circulation due to Gresham’s Law. “Bad money drives out good.”

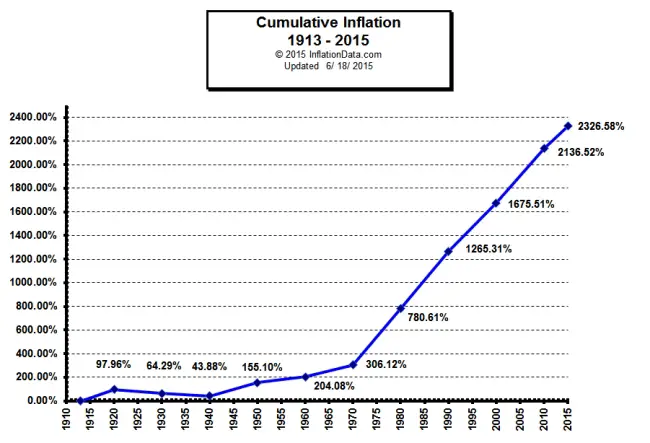

Here is a graph showing the inflation (reduced purchasing power) of the U.S. dollar since the Federal Reserve was created in 1913.

Notice anything happening around 1971? The dollar took off like a hot air balloon that dumped its ballast. That’s not a bad analogy. The value of the dollar was anchored by the precious metals that prevented the Fed from creating money from thin air.

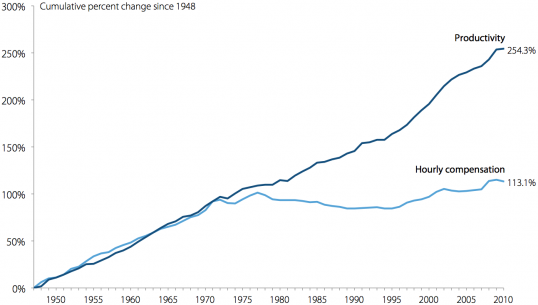

I’ve got two more graphs to show you before I sum things up and make my point. The first one shows that wages, not just the official minimum wage, have not kept up with increases in hourly productivity since… sonofabitch… 1971! Another coincidence?

This next chart may be a bit confusing if you don’t see the note on the left explaining that the light blue line is adjusted for inflation. The minimum wage in the late ’60s was actually $1.60. The $9.54 on the chart was minimum wage’s peak purchasing power in 2014 dollars.

This last chart estimates that if minimum wages had continued to increase in lockstep with the actual productivity of the American economy – in other words, if the unskilled laborer was still getting his or her share of the pie – the minimum wage in 2014 would be $18.42.

Does that sound crazy to you? It’s only crazy if you measure the value of things in the worthless paper called Federal Reserve Notes. The value of which is determined, like anything else, by the laws of supply and demand. The supply OF and demand FOR what? For Federal Reserve Notes! Notes which the Fed exceeds the demand for by increasing the supply by the fucking trillions, purposely creating inflation. Their target is 2%.

That’s right – the Fed reduces the value of our hard earned money – ON PURPOSE! The reasons why are a bit complicated; but, they have to do with the theories of the British economist John Maynard Keynes. In a nutshell, he advocated governments spending money they didn’t have.

As a result, the dollar I was paid for an hour’s worth of bagging groceries in 1963 would be worth just over $18.00 today, IF it was still redeemable in an ounce of silver. Interesting isn’t it? According to the chart above, a minimum wage paid in silver today would have the purchasing power of the minimum wages paid in the ’50s and ’60s.

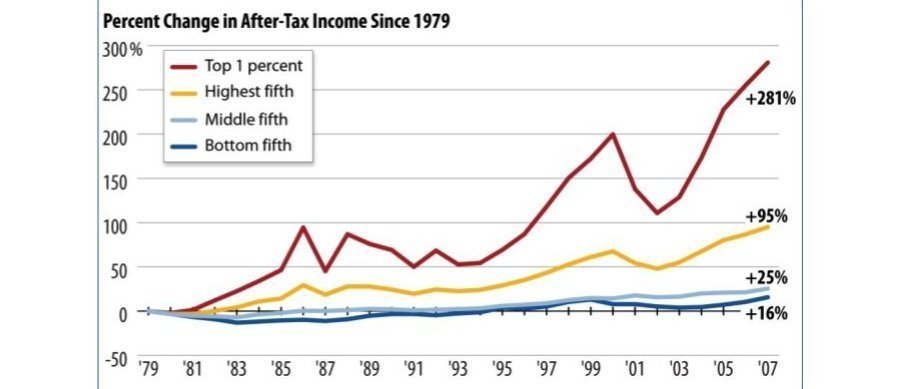

So, if productivity has increased steadily since 1971, but the wages of the laborers who are actually sweating in the factories, on the farms and in the mines and oilfields (and burger joints) of America have not kept pace, then where has the wealth gone?

One more chart ought to give us a clue.

Monetary inflation is like a rising tide. If you’ve got a boat – no sweat. The boat rides with the tide. But, if you are anchored to the shore and the tide rises high enough, you’ll drown.

So what is a boat, analogically speaking? Any asset that rises (increases in nominal value) with the tide of inflation. A few examples are a house, a business, or (as has been the case with one ounce silver coins) precious metals. So, who is anchored to the shore? Minimum wage earners. They are drowning from inflation.

It’s a shame that the free market has left them behind. Maybe it’s time to throw them a life preserver.